The question of how to establish a limited company in Turkey is a frequently asked important matter. The process of setting up a limited company in Turkey involves many details that require careful attention.

In our article, we primarily answered frequently asked questions related to how to establish a limited company in Turkey. We explained the matters that need to be known. We recommend reading carefully.

What is a Limited Company According to Turkish Law?

A limited company refers to a type of company that can be established with a minimum of 1 and a maximum of 50 partners, with a minimum capital of 10,000 TL. The partners are not liable for the company’s debts and are only obligated to pay the capital they have committed.

General regulations related to the establishment of a limited company in Turkey are found between articles 573 and 588 of the Turkish Commercial Code No. 6102. Additionally, there are various provisions on the subject scattered throughout the legislation.

NOTE: We have explained all the details on how to set up a limited company, what it is, and what needs to be known in a Q&A format below. While there are significant benefits to establishing a limited company in Turkey, there are also important responsibilities. Therefore, it’s essential to follow the process with the assistance of a corporate law attorney

How to Establish a Limited Company in Turkey?

The answer to the question of how to establish a limited company in Turkey is not actually very complex. However, what’s essential is to set up the company correctly to avoid long-term legal issues. In other words, it’s necessary to lay the legal foundation of the company properly.

When establishing a limited company in Turkey, rather than following template texts, one should consider the nature of the intended business and act accordingly.

The procedures for establishing a limited company can be summarized as follows:

| HOW TO SET UP A LIMITED COMPANY IN TURKEY? | |

| 1. Stage | The company’s capital, title and line of business should be decided. |

| 2. Stage | After the passport translation is made at the notary, the potential tax number should be obtained from MERSİS. |

| 3. Stage | The company title should be reserved through MERSİS and an application should be made to the chamber of commerce. |

| 4. Stage | Additional provisions for the company’s specific needs should be added to the auto-generated contract from MERSİS |

| 5. Stage | Notarized signature samples of the founders and persons authorized to represent the company should be prepared |

| 6. Stage | Chamber of Commerce appointment should be made through the online system |

| 7. Stage | Competition Authority share and fees and expenses must be paid. Limited company capital does not have to be paid at the establishment stage. |

| 8. Stage | On the appointment day, the company is established with the delivery of the documents to the Chamber of Commerce |

| 9. Stage | For transactions such as e-notification address and monthly declaration, an accountant should be worked with. A bank account must be opened for the company. |

| 10. Stage | KVKK (personal data), VERBİS (online data system) etc. legal proceedings should be done by lawyers. |

Cost of Setting Up a Limited Company in Turkey in 2023

The expenses of setting up a limited company consist of various fees and costs. It is possible to present these items in a table as follows:

| EXPENSE ITEMS | COSTS OF SETTING UP A LIMITED COMPANY |

| NOTARY POWER OF ATTORNEY FEE | Around 700 TL |

| NOTARY SIGNATURE CIRCULARS | Around 700 TL |

| ASSPORT TRANSLATION | Around 500 TL |

| NOTARY APPROVAL OF PASSPORT | Around 700 TL |

| CHAMBER OF COMMERCE FEE | Around 4000 TL |

| CAPITAL | At least 10,000 TL (not mandatory to pay initially; it should be deposited into the company bank account within 2 years after establishment) |

Documents Required for Establishing a Limited Company in Turkey

In Turkey, there are certain minimum documents required for the establishment of a limited company. They can be listed as follows:

- Company establishment petition

- Company articles of association that meet the criteria required by the Trade Registry Office

- Signature declaration issued under the company title for individuals authorized to represent and bind the company

- Receipt for the payment made to the Competition Authority, amounting to 4/10,000 of the company capital

- Photocopy of the chamber registration declaration and signature declaration

- If the company’s establishment procedures will be followed by an attorney, a power of attorney issued by the notary

- For partners of foreign nationality, passport translation and obtaining a potential tax number for the foreigner are required.

In addition to these, some documents specific to the particular case might be required. For example;

- If any of the company partners will be a legal entity, a decision sample related to this from that legal entity is needed. Also, if that legal entity is a company, a trade registry certification is necessary.

- If a foreign legal entity will directly become a company partner, an apostilled translation of the decision made on this matter by the authorized body of the foreign company is necessary.

Limited Company Capital in Turkey

In Turkey, the minimum capital required for a limited company is 10,000.00 TL. Before 2018, this capital had to be deposited in the bank before establishing the company. With a regulation made in 2018, now, the limited company’s capital needs to be deposited into the company’s bank account within 2 years from the establishment of the company in Turkey.

No matter how much company capital is determined, it can be deposited into the company’s bank account within a 2-year period and then withdrawn. Especially, it is necessary to deposit it as a capital payment and present this document to the tax office.

When determining the company capital and making the deposit, a proper evaluation should be made, and actions should be taken accordingly. Otherwise, a capital increase may be required later on, and unnecessary additional fees and expenses may need to be paid.

Opening a Bank Account for Limited Company in Turkey

It is mandatory for a limited company to have a bank account in its name. The choice of bank is not significant. Any bank will require a specific bank account for the limited company. Banks usually prefer to first open a personal account when opening a bank account in the name of a company. Especially, they open a bank account in the name of the company’s shareholder or manager and subsequently open the company account.

Limited Company Main Contract

The main contract of the limited company is automatically generated during the MERSIS (Online System) application in Turkey. In other words, after selecting the company’s field of activity and other features through the online system, it is automatically established. However, the truly crucial part starts afterward. To the contract text automatically generated by the system, additions and deletions can be made, taking into account the company’s features and possible disputes that might arise in the future. It is essential to do this with the help of a lawyer.

It should be noted that the limited company main contract does not have to be in the draft text form obtained from MERSIS. This entire contract can also be manually prepared by lawyers. Such an approach is taken during the establishment of specially qualified and large-capacity companies. We have explained the mandatory and discretionary issues that need to be written in the limited company main contract in the frequently asked questions section below.

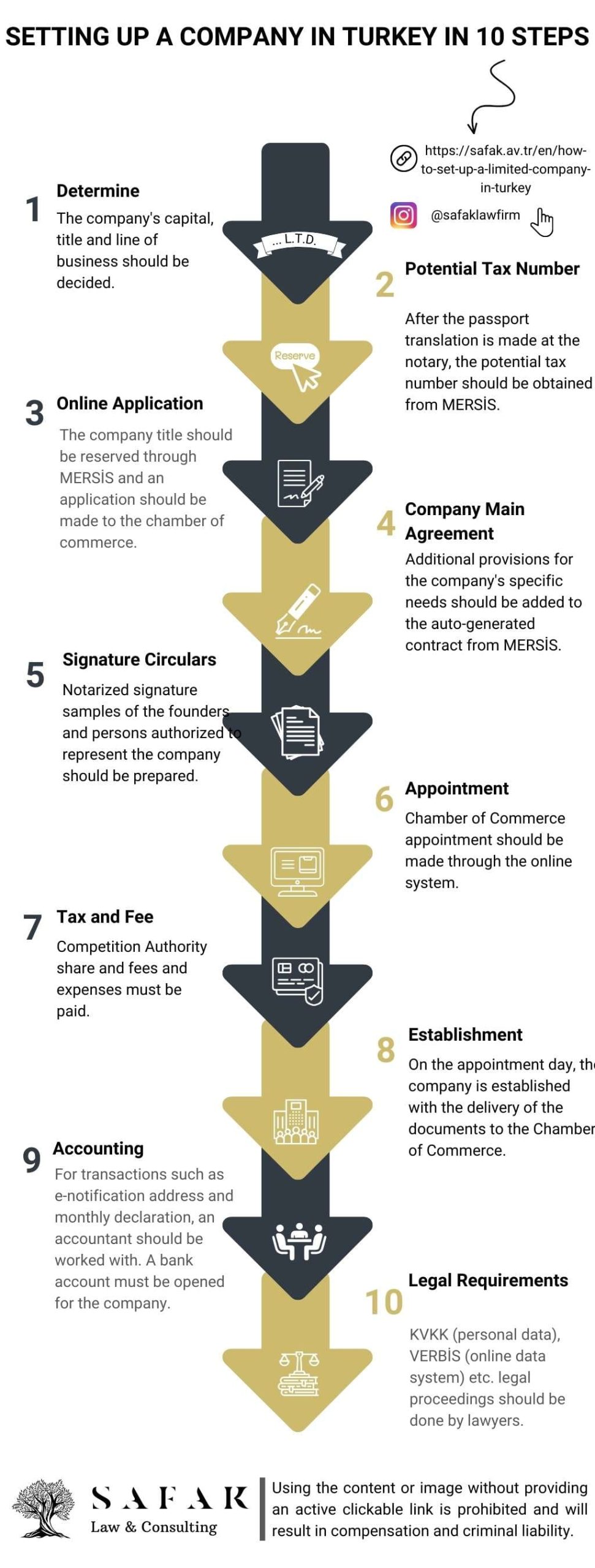

Stages of Setting Up a Limited Company in Turkey

Above, we went into detail about the limited company establishment process. In this section, we want to explain the stages of establishing a limited company with a visual.

What Path Should Be Followed When Setting Up a Single-Shareholder Limited Company?

In this case, the company has a single shareholder. This sole shareholder can also be the company’s director. When giving a power of attorney to the accountant and lawyer, this sole shareholder should be careful. The power of attorney should grant authority separately in their name and in the name of the company.

The company director should register that the company is single-shareholder, the name of the shareholder (this person can be themselves or someone else), their citizenship, and their place of residence.

Having a single shareholder for the company does not eliminate certain procedural processes. For instance, general assembly procedures must be done even if there is only one person.

What are the Advantages of a Limited Company in Turkey?

In Turkey, the general advantages of a Limited company include:

- Having a low minimum capital,

- More relaxed and flexible control and management processes,

- Not requiring immediate capital investment,

- Company shares being registered in the name,

- Having a limited number of partners,

- The establishment processes being less costly and easier compared to other types of companies.

These can be listed as the main benefits.

Frequently Asked Questions

We find it useful to answer frequently asked questions regarding the establishment of a limited company and generally about this type of company.

How Many People Are Required to Establish a Limited Company in Turkey?

In Turkey, a limited company can be established with a minimum of 1 and a maximum of 50 partners. Partners can be individuals or legal entities (companies, organizations, etc.).

Is Ministry Approval Required to Establish a Limited Company in Turkey?

There is no need for ministry approval to establish a limited company in Turkey. However, for certain specific business lines, permission from the related ministry is required to operate.

Is a Written Agreement Mandatory for a Limited Company?

The limited company agreement must be written and signed by the partners during the establishment phase. This agreement is registered with the chamber of commerce.

What Should be Included in the Limited Company Agreement?

The mandatory details that must be included in the limited company agreement can be found in Article 576 of the Turkish Commercial Code. Accordingly, the following must mandatorily be included in the limited company agreement:

-The trade name of the company,

-The head office of the company,

-The business subject of the company (its limits should be broadly and clearly defined),

-The nominal value of the company’s basic capital,

-The number and nominal values of the company’s capital shares,

-Privileges, if any,

-Groups of the company’s basic capital shares,

-The name, surname, title, and nationality of the company’s directors,

-How the company will make its announcements.

What Can the Company Owner Add to the Limited Company Agreement?

The fundamental agreement of a limited company is very important. This agreement is automatically formed when the required details are entered into MERSİS (online system). However, some issues can be added to the limited company agreement additionally. They can be listed as:

-Issues other than statutory provisions concerning the restriction of the transfer of basic capital shares,

-Granting the right of being addressed with an offer, pre-emption, repurchase, and acquisition rights to the partners or the company itself in case of the transfer of a basic capital share,

-Form and scope of additional payment and ancillary service obligations,

-Granting veto rights to certain partners,

-Granting superiority to some partners’ votes in case of an equal number of votes in a general assembly decision,

-Penal provisions to be applied in case of non-compliance with obligations stated in the law or the agreement,

-Non-compete provisions other than statutory regulations,

-Special rights regarding convening the general assembly,

-Provisions that deviate from statutory regulations on decision-making, voting, and vote counting in the general assembly,

-Authorization concerning delegating the company management to a third person,

-Provisions related to the use of balance sheet profits, other than statutory regulations,

-Recognizing the right to withdraw from partnership and the conditions for using this right, and the nature and amount of the departure fee to be paid in these cases,

-Special reasons related to the expulsion of a partner from the company,

-Reasons for ending the company other than those stated in the law.

NOTE: These provisions, which can be optionally added to the limited company’s basic agreement, should not be contrary to the imperative provisions in the Turkish Commercial Code. Otherwise, they will be invalid.

Can the Main Agreement of a Limited Company Be Changed Later in Turkey?

According to Article 589 of the Turkish Commercial Code, the main agreement of the company can be changed with the decision of the partners representing two-thirds of the basic capital. However, a different provision regarding this ratio can be included in the company’s agreement.

When a change is made in the limited company agreement, it must be registered and announced in the Trade Registry Gazette.

What is the Result of Transactions Before a Limited Company Acquires Legal Personality in Turkey?

Before the limited company is established, business and transactions may have been carried out in the name of this limited company to be established in the future. If the limited company accepts this transaction within 3 months after its establishment, these become valid. However, those who carry out these transactions become jointly and severally liable with the company.

What Happens to a Company Established Against the Turkish Law?

Even if a limited company is established unlawfully in Turkey, the company cannot be declared nonexistent. However, within 3 months from the establishment of the company, creditors, shareholders, the Ministry of Customs and Trade of the Republic of Turkey, company directors, or company partners can file a dissolution lawsuit by applying to the Commercial Court of First Instance. In this lawsuit, the company is given time to rectify its deficiencies. If the company acted against public order during its establishment, the ministry can file a dissolution lawsuit within 1 year of learning about these actions.

Which Companies in Turkey Are Obligated to Open a Website?

Companies subject to independent audits must open a website. For a company to be subject to an independent audit, it must meet at least two of the following three criteria:

-Companies with a total active sum above 150,000,000 TL

-Companies with an annual net sales revenue above 200,000,000 TL

-Companies employing 500 or more workers

What are the Mandatory and Optional Bodies of a Limited Company in Turkey?

Limited companies have two main bodies, which are mandatory for them. These are the general assembly and the board of directors. In single-partner limited companies in Turkey, both the general assembly and the board of directors consist of the same person. For limited companies, the “auditor” is not a body.

The general assembly and the board of directors are mandatory bodies, but in addition to these, optional bodies can be established. For instance, a body can be established to manage the company’s financial accounts, and its working method and obligations can be determined either by the main contract or by an external contract within the company.

In Which Areas Can Limited Companies Operate in Turkey?

Limited companies in Turkey can engage in any business that is not legally prohibited. However, some businesses, such as banking and insurance, can only be conducted under joint-stock companies.

Is It Mandatory to Pay the Entire Capital When Establishing a Limited Company in Turkey?

When establishing a limited company in Turkey, it is not mandatory to pay the entire capital. This amount must be deposited into the company’s bank account within 2 years from the establishment.

Can the Capital of a Limited Company Be Increased or Decreased Later?

In Turkey, the capital of a limited company can be either increased or decreased. According to the provisions of the Turkish Commercial Code, Article 591 and the following articles, this change can only be made with a change in the main contract.

Are Company Partners Liable for Company Debts in Turkey?

Partners of limited companies in Turkey are not personally liable for company debts. They only have the obligation to pay the capital amounts they have committed and to fulfill additional payment and ancillary obligations provided for in the company contract. However, they can be held responsible for the company’s tax and SGK (Social Security Institution) debts.

What is the Responsibility of the Limited Company Manager in Turkey?

In Turkey, two types of responsibilities arise for the manager of a limited company. These are criminal and legal responsibilities.

When acting on behalf of the company, if the manager of the limited company acts contrary to the Turkish Penal Code or other legislative regulations containing criminal provisions, they are held responsible, despite acting on behalf of the company.

Managers of the limited company can be held accountable for the company’s tax debts, namely tax and SGK premium debts (according to the Tax Procedural Law No. 213, Article 10 and Law No. 6183 AATUH Article 35).

Is a Limited Company a Personal Company?

A limited company is a capital company. It is not a personal company according to the legal definition. In Turkey, limited companies have legal personality. In other words, a limited company is a legal entity.

Is It Possible to Buy a Car on a Limited Company in Turkey?

It is possible to buy a car under a limited company in Turkey. Companies can have assets and liabilities. Motor vehicles are also part of these assets.

Can Share Transfers Be Made in Limited Companies in Turkey?

Share transfers are possible in limited companies. All or some of the shares of a limited company can be transferred to an individual or another company or legal entity for a certain fee. A foreign company can establish a limited company in Turkey and buy shares of this company.

Can a Limited Company Established by Multiple People Later Convert to a Single Partner in Turkey?

Yes, it can. This transformation can be made possible by one partner exiting the company, being expelled, or selling their share in the limited company to the other partner. In this case, the company partner is obligated to notify the company manager in writing within 7 days. The company manager must register and announce this change (partner’s name, nationality, and residence). If the company manager does not fulfill this obligation, they can be held responsible for any possible damages. If the company manager and the partner are the same person, then the owner-partner must carry out this task in their capacity as a manager.

What are the Tax Rates for Limited Companies in Turkey?

Tax rates for limited companies are quite technical in terms of accounting. Even though there are basic tax items, many factors can increase or decrease these amounts. However, it is possible to list the general tax rates for limited companies as follows:

| Limited Company Tax Rates | |

| V.A.T. (K.D.V.): | 1% – 20% (varies based on the product, not the type of company) |

| Income Tax | 15% – 40% (determined based on income bracket) |

| Corporate Tax | %25 |

In addition to the taxes listed above, there are various tax items in Turkey, such as withholding tax, income provisional tax, etc. However, as mentioned, these are specialized accounting topics.

Differences Between Joint Stock Company (Anonim Şirket) and Limited Liability Company (Limited Şirket)

| Criteria | Joint Stock Company (Anonim Şirket) | Limited Liability Company (Limited Şirket) |

| Liability for Company’s Tax and Social Security Debts | A shareholder who is not a member of the board has no responsibility, not even a single penny, for the company’s unpaid taxes and social security debts. | Shareholders are responsible for the company’s unpaid taxes and social security debts that can’t be collected from the company or the manager. |

| Share Transfer | The transfer of shares does not require notary approval and there’s no obligation for registration in the trade registry. | The transfer of shares must be done through a notary. A general assembly decision is also required. The share transfer approval must be registered in the trade registry. |

| Public Offering | Shares of a joint-stock company can be offered to the public. | Shares of a limited company cannot be offered to the public. |

| Repayment of Loans Given by Partners | Loans and resources provided by partners or their close relations, which serve as equity, can always be repaid. | Loans and resources provided by partners can only be repaid to the partners after all other debts are settled. |

| Taxation on Sale of Shares | Gains from the sale of shares are not subject to income tax after holding them for two years. | Gains from the sale of shares are subject to income tax regardless of the holding period. |

| Number of Shareholders | The number of shareholders can be unlimited. | The number of shareholders is limited to a maximum of 50. |

| Minimum Capital Amount | The minimum capital amount is 50,000 TL. | The minimum capital amount is 10,000 TL. |

| Nature of Shares | Shares are bearer shares. | Shares are registered in the name of the owner. |

In Conclusion, Points to Consider

There are myriad details to understand about limited companies that this article cannot entirely cover. For instance, limited companies can undergo complete or partial divisions, they can transform into another type of company, or merge with another company. They can also open branches or representative offices.

When establishing a limited company, it’s crucial to lay its foundation correctly to avoid legal problems in the long run. For this reason, working with an attorney is of utmost importance.

Regardless of whether it’s a large or small company, establishing and operating within the scope of a limited company brings significant advantages as well as responsibilities. Therefore, regular legal consultation is beneficial, and having transactions conducted by an attorney is advisable.

You can contact us through the “ask a lawyer” section to get detailed information on the subject.