In Turkey, the transfer of shares in a limited company may appear to be a straightforward procedure, yet it can lead to severe consequences if not carefully managed. It is absolutely essential to follow this process with legal assistance in Turkey.

Below, we have answered all the questions you may have about the share transfer process of a limited company in Turkey. We recommend that you read carefully and in the proper order.

How to Share Transfer of a Limited Company in Turkey?

In its simplest terms, the transfer of shares in a limited company is conducted at a notary office along with a transfer agreement between the seller and the buyer. The approval of the general assembly is a crucial requirement for the share transfer of a limited company in Turkey.

The share transfer process of a limited company involves important details that require attention. It is necessary to obtain legal advice during this process.

Costs of Share Transfer of a Limited Company in Turkey

The 2024 Trade Registry Service Fees list states that a service fee of 2000 TL will be charged for the share transfer transaction of a limited company. The advertisement fee for the Turkish Trade Registry Gazette is charged per word. In the 2024 tariff, a fee of 2.95 TL per word has been set.

Apart from this, other expenses vary proportionally depending on the share transfer price. However, share transfer is generally one of the less costly processes among limited company transactions.

In Turkey, the attorney fee for the transfer of shares in a limited company is freely determined between the attorney and the client. There is a published schedule of attorney fees by the bar associations in Turkey.

For the share transfer transaction of a limited company, the fee determined by the Istanbul Bar Association No. 2 for 2024 is 33,000.00 TL. However, this fee can increase or decrease depending on the scope of the specific case and the variety of tasks to be performed.

Required Documents for Share Transfer in a Limited Company

In Turkey, the process of share transfer in a limited company requires a set of documents. We can list them as follows:

- Signed and stamped transfer notification petition

- Resolution of the general assembly of the limited company approving the share transfer

- Notarized share transfer agreement of the limited company

- A copy of the page of the share register that has been processed

In some special cases, the following documents are required:

- If the transferring or receiving partner is a legal entity, a trade registry certification obtained within that year

- If the transferring or receiving partner is a foreigner, a notarized translation of the passport for individuals

- If the transferring or receiving partner is a foreign legal entity, a registry document translation certified with an apostille from the competent authority and notarized

- If the share transfer or distribution is due to death, the original decree of inheritance and the resolution of the general assembly based on this decision regarding the distribution of shares (notarized)

- Residence document for a new partner who does not have a residence record in the Identity Sharing System or whose population registration is in another province

- If a partner is a minor (under 18), the signatures of the parents or a guardian appointed by the court must be present on the listed documents

- A sample of the Turkish Trade Registry Gazette in which the call for the general assembly meeting was published

Limited Company Share Transfer Agreement in Turkey

The first thing that the parties must do is to draft a limited company share transfer agreement that meets the validity requirements. This agreement should include:

- Basic identity information of the party who will buy and sell the share,

- The transfer price and method of payment,

- Additional payments and ancillary obligations,

- Non-compete clauses, and whether these clauses will apply to other partners,

- Right to be offered,

- Rights of first offer, pre-emption, and repurchase, if any, and their conditions,

- Penalties for non-compliance with the agreement.

It is important to note that one of the most critical stages in the share transfer of a limited company in Turkey is this share transfer agreement stage. This agreement should be prepared in a manner that will not cause problems in the long and medium term, as it will be notarized.

It is absolutely necessary to avoid using template and ready-made texts. A contract that best represents the legal relationship between the parties should be prepared by a Turkish corporate law attorney.

General Assembly Approval in Limited Company Share Transfers

In Turkey, the approval of the general assembly is mandatory for the transfer of shares in a limited company, as stated in Article 595/2 of the Turkish Commercial Code. A limited company share transfer is valid only after the approval of the general assembly. The approval of the general assembly is also required for registration in the Turkish Trade Registry.

The decision of the general assembly must be recorded through MERSIS (Central Registry Recording System). How to proceed if the general assembly does not approve is explained below.

IMPORTANT: The decision of the general assembly must also be signed by the partner transferring their share. This is because the transfer is not yet effected by the contract alone. The transfer is considered to have taken place after the general assembly’s decision.

ATTENTION: There is no need to provide details about the payment of capital in the general assembly decision. If it is stated that the capital has been paid, then a certificate of activity and a report should also be added

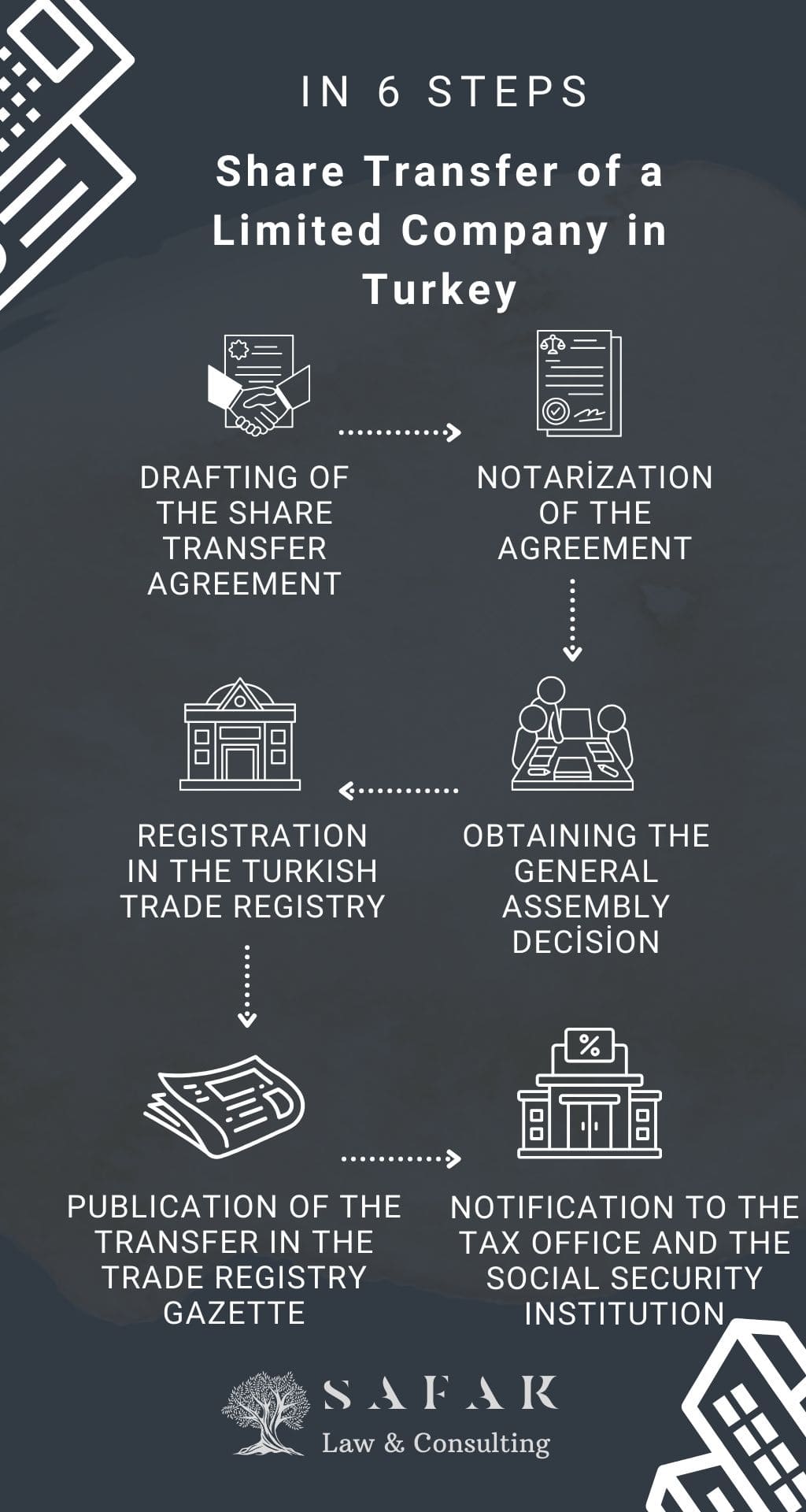

Stages of Share Transfer in a Limited Company in Turkey (SUMMARY)

The stages of share transfer in a limited company can be summarized in six basic steps. We can list them as follows:

- Drafting the share transfer agreement for the limited company,

- Notarization of the agreement,

- Obtaining the general assembly decision approving the share transfer,

- Registration of the decision and the transfer in the Trade Registry,

- Publication of the transfer in the Trade Registry Gazette (automatically published after registration),

- Reporting the transfer process to the tax office and the Social Security Institution (SGK).

In Turkey, the stages of share transfer in a limited company are not inherently complicated. The process can be completed quickly. However, we see that a simple mistake in any of these stages can lead to serious legal problems. Sometimes, correcting this mistake may not be possible, and even if it is possible, it can result in significant damages.

Taxation and Duties on Share Transfer in Limited Companies in Turkey

Under Article 80 of the Income Tax Law No. 193, the gains arising from the “disposal of partnership rights or shares” are considered as capital gains and are subject to income tax. The term “disposal” is defined in the same article to mean “selling, transferring and handing over against consideration, exchanging, swapping, expropriation, nationalization, or contributing as capital to commercial companies.” Therefore, if the person transferring the limited company share has realized a capital gain, they are obligated to pay income tax on it.

For individuals transferring shares, VAT (Value Added Tax) is not paid. The income derived from this transaction is not subject to VAT. However, for corporations and companies transferring ownership of limited company shares; if the limited company share is sold within 2 years after its acquisition, no VAT liability arises. However, if it is transferred after 2 years, VAT liability arises. Additionally, no stamp duty or other duties are paid in the transfer of limited company shares.

If this were to be shown in a table:

| Taxation of Share Transfer in Limited Companies | |

| Income Tax | Present |

| VAT in Share Transfer by Individuals | Absent |

| VAT in Share Transfer by Legal Entities | Present if ownership exceeds 2 years, absent if less than 2 years |

| Stamp Tax | Absent |

| Duty | Absent |

Responsibility of the Transferring and Acquiring Partners for Company Debts

According to Article 35 of the Law No. 6183 on the Procedure for Collection of Public Debts, partners in a limited company in Turkey are personally liable for the company’s debts to the state in proportion to their shares. However, the state must first attempt to collect the debt from the limited company and fail to do so.

Debts of the limited company to entities other than the government, that is, debts to other individuals and companies, do not personally concern the partners. Partners are not personally liable for these debts.

In the transfer of shares in a limited company, the partner acquiring the shares becomes jointly and severally liable with the transferring partner for public debts incurred before the transfer. This means both are jointly responsible for these debts. The transferring partner is not responsible for public debts that arise after the transfer.

We can illustrate the responsibility for debts during a limited company transfer in a table (ONLY FOR DEBT TO THE GOVERNMENT):

| Transferring Partner | Acquiring Partner | |

| Before Transfer Debt | Responsible | Responsible |

| After Transfer Debt | Not Responsible | Responsible |

| Debt Incurred Before Transfer But Due After Transfer | Responsible | Responsible |

IMPORTANT: Sometimes, the transfer of a business (enterprise) is confused with the transfer of a limited company. The responsibility of the partners in a business transfer is regulated by Article 202 of the Turkish Code of Obligations No. 6098. The person who acquires a business, including its assets and liabilities, is responsible for the business’s previous debts. The transferring party is also responsible for these debts for a period of 2 years. This period begins from the announcement of the transfer by the acquiring party in the Trade Registry Gazette. If this announcement is not made, the 2-year period does not start. This is the issue often confused with the “2-year liability in limited company share transfer”.

FREQUENTLY ASKED QUESTIONS

Above, we discussed the basic information regarding the transfer of shares in a limited company in Turkey. Below, you will find answers to frequently asked questions about this topic.

What Happens If the General Assembly Does Not Approve the Share Transfer in a Limited Company?

If the articles of association of the limited company do not include a provision regarding the approval of share transfers; the general assembly of the limited company can reject the share transfer request without providing any reason.

Additionally, if the general assembly believes that the partner purchasing the share may not be able to fulfill the company’s additional payment and ancillary obligations, it can request a guarantee from that partner. If this guarantee is not provided, the request for share transfer can be rejected.

In this case, the partner in the limited company has the right to withdraw from the partnership for just cause.

How Are Transfer Registration and Share Ledger Entry Made in Turkey?

In the transfer of shares in a limited company, registration and share ledger entry are recorded in the registry through MERSIS (online system). In fact, in this application, the general assembly decision, registration petition, photocopy of the share ledger, and notarized transfer agreement are included together.

How Is the Transfer of Shares Attached to a Certificate Conducted in Turkey?

Although some old decisions of the Yargıtay (Turkish High Court) and various views in legal doctrine might show different conditions for the transfer of shares attached to a certificate, in practice, the transfer of shares attached to a certificate is carried out according to Article 595 of the Turkish Commercial Code, that is, according to the procedure explained above.

How is the Transfer of Shares in a Limited Company Done in Case of Inheritance?

The only difference in the transfer of shares in a limited company due to inheritance is the addition of the original decree of inheritance and a notarized general assembly decision showing the distribution of shares to the documents required for registration of the transfer. Other than that, the process remains the same.

How are Shares in a Limited Company Divided and Transferred in a Divorce in Turkey?

In a consensual divorce, the parties can agree as they wish regarding shares in a limited company. In a contested divorce, shares in a limited company are subject to the liquidation of the matrimonial property regime. However, in Turkey, limited company assets are not subject to divorce property division, and no precautionary measures can be placed on the company’s assets, as these assets belong to the corporate entity, not to the spouses. During the division of property after a divorce, the court will have an expert calculate the monetary value of the company shares, and the party holding the shares pays, roughly speaking, half of this value to the other party.

Can a Lawsuit be Filed to Cancel the Transfer of Shares in a Limited Company in Turkey?

The transfer of shares in a limited company can be canceled. However, this can be done in cases such as concealing assets from an inheritance, defects in the buyer’s consent, or fraudulent transfers. Furthermore, those who have suffered damage from such malicious transfers can request the cancellation of the share transfer. Other heirs can sue in cases of concealing assets from an inheritance. A person whose consent was impaired through mistake, fraud, or duress can sue. Or, a person who has suffered from a sham transfer can file a lawsuit. The timing and procedural requirements vary depending on the reason for filing the lawsuit.

Can the Transfer of Shares in a Limited Company be Done Through a Power of Attorney?

The transfer of shares in a limited company can be done through a power of attorney. A special power of attorney is required for this, meaning the power of attorney must explicitly authorize the transfer of shares in a limited company.

Is There a Statute of Limitations for the Transfer of Shares in a Limited Company?

There is no statute of limitations for the transfer of shares in a limited company. The parties can make the transfer at any time, provided they comply with the procedure.

Should a Notification to the Social Security Institution (SGK) be Made in the Transfer of Shares in a Limited Company?

The final stage in the transfer of shares in a limited company is notifying the tax office and the Social Security Institution (SGK). Thus, notification to SGK is mandatory.

How Long Does a Share Transfer in a Limited Company Take in Turkey?

The transfer of shares in a limited company, when the necessary documents are properly prepared, is completed in approximately 3-4 days.

Can the Transfer of Shares in a Limited Company be Blocked in Turkey?

The transfer of shares in a limited company can be blocked by the company’s general assembly. If the transfer is not approved, it is invalid and does not take effect. Precautionary measures can also be placed on the company’s shares, but this is only possible through legal proceedings.

Is Notarization Required for the Transfer of Shares in a Limited Company?

The transfer of shares in a limited company must be notarized. According to Article 595/1 of the Turkish Commercial Code, the share transfer agreement and the promise of share transfer agreement must be in writing and notarized.

What Should Be Done If a Limited Company Ends Up With a Single Partner After Share Transfer?

According to Article 574 of the Turkish Commercial Code, when the number of partners decreases to one, this must be reported in writing to the director of the limited company within 7 days from the transaction that resulted in this outcome.

The director must then register and announce this change, including the remaining single partner’s name, residence, and nationality within 7 days of receiving the notification. Otherwise, the director is liable for any potential damages.

Can an Inheritance of Shares in a Limited Company be Disclaimed in Turkey?

Shares in a limited company can be inherited, and the right to disclaim such an inheritance exists. The period for disclaiming an inheritance of company shares is 3 months, starting from the death of the decedent. If the death of the decedent is learned later, the 3-month period starts from the date of learning.

Is There a Right of Pre-emption in the Transfer of Shares in a Limited Company?

According to Article 577/1-b of the Turkish Commercial Code, a right of pre-emption can be granted to partners or to the company itself if specified in the articles of association. Not only the right of pre-emption but also rights to buy or re-buy can be granted. However, if such a right is not anticipated in the articles of association of the limited company, the partners do not have such a right. Therefore, it is important to review the articles of association of the limited company before the transfer.

When Does a Share Transfer in a Limited Company Become Effective in Turkey?

A share transfer in a limited company becomes effective when the transfer agreement made at the notary is approved by the general assembly.

Conclusion

Above, we provided general information on the process of share transfer in a limited company and answered frequently asked questions. This process should not be underestimated, as many transfer processes in Turkey have unique characteristics. To avoid problems in the long and medium term, it is essential to consult a Turkish corporate law attorney first.